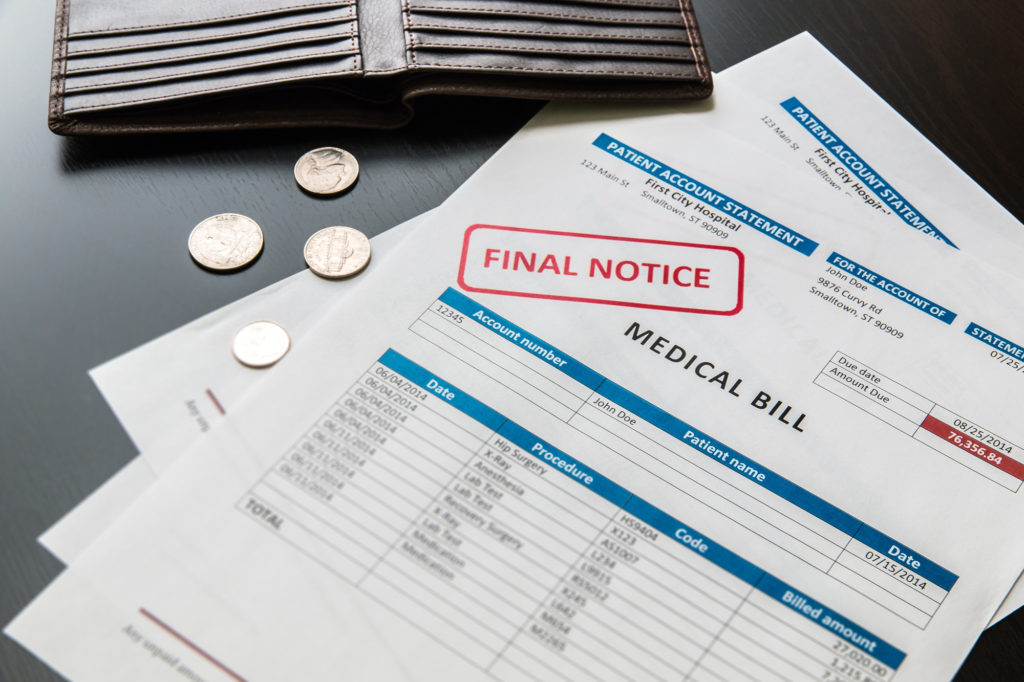

When we are sick, our primary focus should be on getting better. For many people, though, figuring out how to pay for their medical care can be all-consuming. This is true whether they suffer from a chronic illness or had an unexpected emergency.

The numbers bear this out. According to a 2016 survey, 26% of adults reported they or someone in their household struggled to pay their medical bills.

What’s more, this isn’t just a problem of the uninsured. Insured individuals are also blindsided by high deductibles, large co-pays, or unexpected out-of-network bills.

Maybe you are desperately trying to keep up with unpaid medical bills. You know how quickly they add up, covering you slowly under a mountain of debt.

Is there any way out of that mess? Below we show you some tricks to help you manage your medical bills. We’ll help you make sure they don’t get out-of-hand. Let’s go!

What To Do for Medical Bill Debt

When faced with a pile of bills, it’s easy to become overwhelmed and bury your head in the sand. But ignoring them won’t make them go away. Instead, they’ll get sent to a collection agency, and you’ll be harassed by collection agents day and night!

For this reason, it’s better to deal with your bills. This is true if you knew they were coming or if they were unexpected bills.

Let’s look together at four tips to help you cope with your unpaid hospital bills. Read on!

1. Make Sure You Understand All Aspects of Your Bill

Medical bills are notoriously complicated. After a hospital stay, for example, you might come home to different bills from different doctors as well as one from the hospital itself. It can be hard to know who performed what service and how much they are charging for it.

What’s more, the insurance company figures you won’t understand your bill anyway. They think the codes, procedures, and technical language are all too complicated. Because of this, you will just pay the bill.

But you have to work your way through this bureaucratic mess. Otherwise, you have no way to advocate for yourself.

Below let’s examine the different types of medical correspondence you can expect to receive.

Statements, Explanations of Benefits, and Finally, Your Bill

Your medical bill is generally the last type of correspondence you receive from your doctor’s office or hospital. First, you will receive a statement (or two or three!).

This document includes the total charges incurred. It also includes estimated payments, both for the insurance company and yourself.

Next, you will receive an Explanation of Benefits (EOB) document from your insurance company. Neither the statement nor the EOB is a bill. From the EOB, you learn how much the insurance company ended up paying the hospital.

Once the insurance company has made its payment, you will receive a bill from the hospital. Before paying it, compare your statement(s) to the EOB. This is one of the easiest ways to spot discrepancies.

2. Go Over All Your Documents Carefully

Why do you need to be able to understand statements, EOBs, and bills? Because often your unpaid hospital bills will contain errors.

No one really knows how many bills regularly have mistakes, and figures vary widely. Some estimates suggest that you can find errors in up to 80% of medical bills.

Whatever the real number, these mistakes can be extremely costly–for you! Even with insurance, high deductibles and out-of-network fees mean they are often catastrophic.

Therefore, don’t pay any bill until you understand it completely and are absolutely sure it is mistake-free.

3. Don’t Be Afraid to Negotiate

When you are behind on your medical debt, it is hard asking for help. You might feel embarrassed calling your doctor’s office, especially when you are asking them to lower your bill.

But keep a number of factors in mind.

First, the items listed in your bill do not have fixed dollar amounts. The amounts charged might be so variable that they seem random. This is especially true for hospitals where people are charged excessive amounts for bandages and Tylenol.

Second, the doctor’s office or hospital wants you to pay your bill, even if you have to pay in installments. They may even have a financial counselor on staff to help work out payment plans.

There’s no harm, then, in calling your hospital or doctor’s office to see if you can get a discount on your bill. In fact, with a little research, you can find what other providers are charging and mention that information when you call. Resources such as the Healthcare Bluebook or the Fair Health’s consumer website can give you examples of average costs.

A financial counselor is used to receiving calls like yours, and they want to help you. They may also be able to work out a payment plan. This will allow you to pay your bill in installments, and, as long as you pay them on time, will prevent it from going to a collection agency.

The hospital may even offer something called “charity care.” You have to earn less than 200% of the poverty level to qualify, but if you do, the hospital might forgive some or all of your debt.

One Last Tip When Negotiating

Remember to ask for the same person each time you call the office. Get their number and extension, and develop a relationship with them. That way you don’t have to repeat your story each time you call the office. They will know you already and have all the information they need about your financial situation.

4. See If You Qualify for Medicaid

Medicaid is a health insurance program run by both the federal and state governments. It provides health insurance for low-income individuals. Pregnant women, parents, senior citizens, and disabled individuals may also be eligible.

To find out if you qualify, you have to call your state Medicaid office. If you have children, they may qualify for the program even if you don’t, so it’s definitely worth looking into.

Also, Medicaid will pay for medical expenses already incurred, but only within a certain amount of time. Calling the Medicaid office as soon as you get your bill is the best to ensure it will be covered.

Wrapping Up: Unpaid Medical Bills

Managing your unpaid medical bills when you are sick can be frustrating and stressful. Taking care of them as soon as possible, though, is the best way to ensure they don’t get sent to a collection agency. It never hurts to ask for discounts or an installment plan, but the only way to know if you will get these things is to call and ask.

If you enjoyed this article, you might want to check out other articles on our site. They cover a wide array of interesting and unusual topics, such as movies and musical performers. There’s bound to be something that interests you!